Harley Davidson Financial Analysis

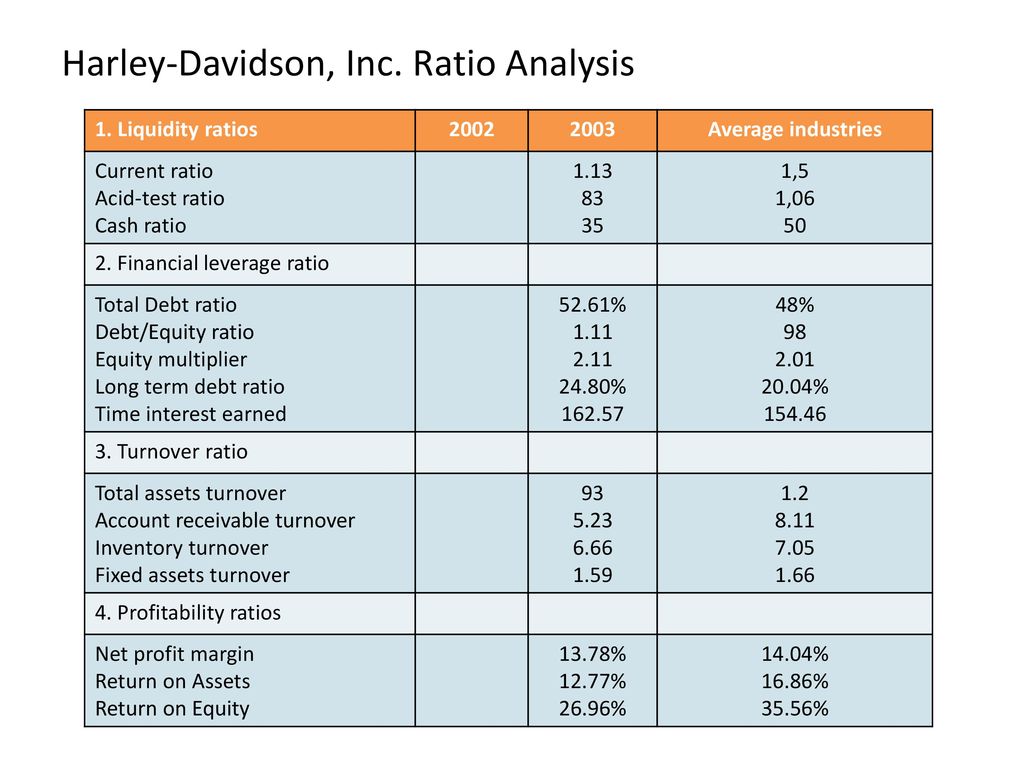

Check the Dupont Ratios Analysis of HOG Harley-Davidson Inc.

Harley davidson financial analysis. This project is for the FA -18 Financial Management Course at Wisconsin Luther College. Income statements balance sheets cash flow statements and key ratios. Includes annual quarterly and trailing numbers with full history and charts.

AUG 2011092712 1 2. Harley-Davidson manufactures heavyweight motorcycles as well as a complete line of parts apparel and accessories for motorcycles. Hereafter the Company for the year 2020 submitted to the US.

Engages in the production and sale of heavyweight motorcycles. After peaking with 6. It operates in two segments Motorcycles and Related Products and Financial Services.

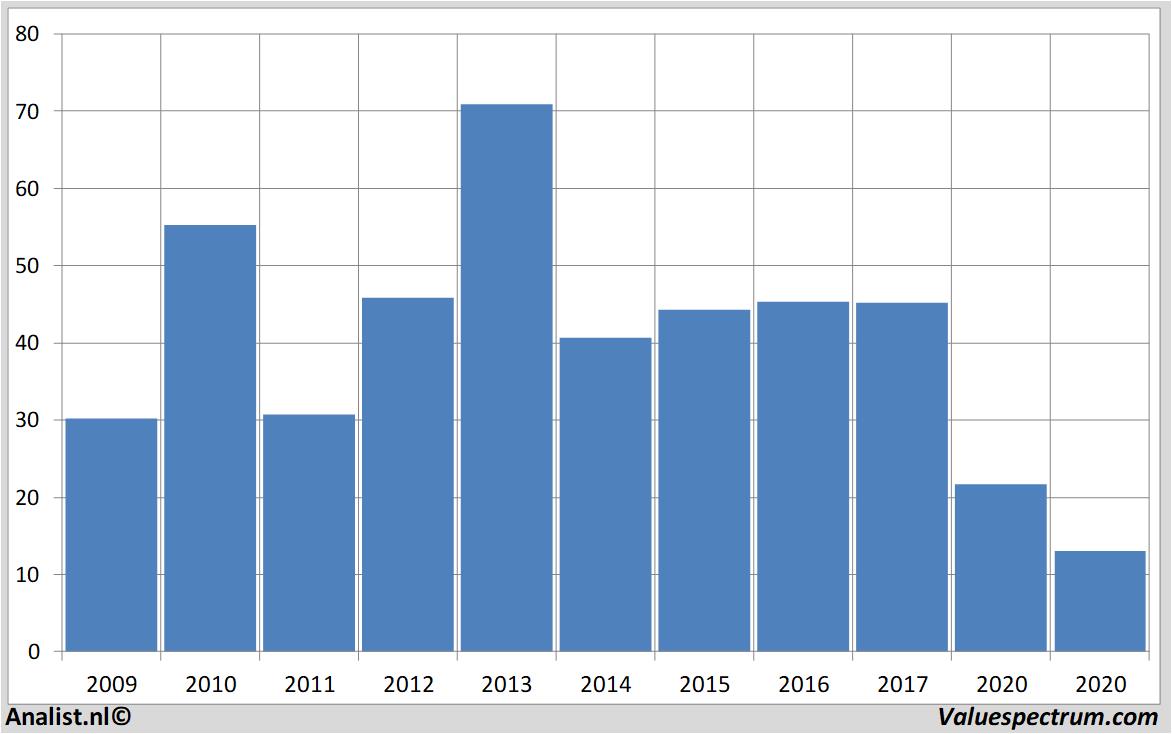

The EVEBITDA NTM ratio of Harley-Davidson Inc. Harley consists oftwo segments. EBTEBIT The companys operating income margin or return on sales ROS is EBIT.

Ten years of annual and quarterly financial statements and annual report data for Harley-Davidson HOG. Ten years of annual and quarterly financial ratios and margins for analysis of Harley-Davidson HOG. Is lower than its historical 5-year average.

Harley Davidson Financial and Strategic Analysis Review 989 Words 4 Pages. This will be 100 for a firm with no debt or financial leverage. We have conducted a comparative analysis of the balance sheet and the income statement of Harley-Davidson Inc.