Harley Davidson Financial Outlook

Harley-Davidson HOG Outpaces Stock Market Gains.

Harley davidson financial outlook. Moodys downgrades Harley-Davidson long-term rating to Baa2 affirms P-2 short-term rating. On March 24 2021 Fitch Ratings downgraded the ratings of Harley-Davidson Financial Services Incs HDFS by one notch as its ratings and Outlook are linked to those of its parent Harley-Davidson Inc. Fitch views HDFS as a core subsidiary of HOG based on HDFSs close operating relationship and support agreement with HOG 100.

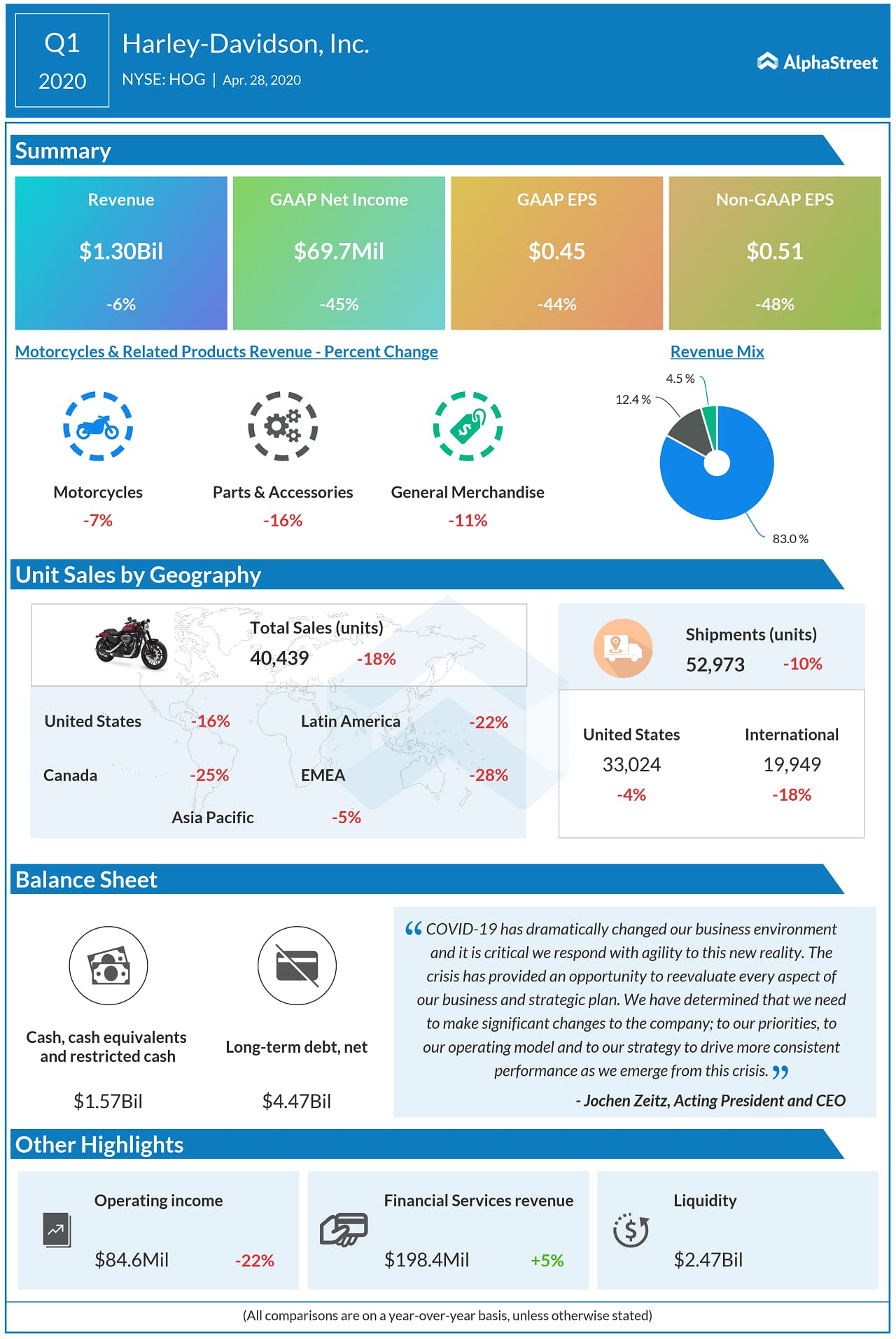

Reuters - Harley-Davidson Inc on Thursday withdrew its financial forecasts as the coronavirus outbreak hurts its supply chain and warned further. The outlook is stable. Harley-Davidson is not the only US automaker to withdraw its financial forecasts for this year due to coronavirus.

Cash - Cash and cash equivalents were 33 billion at the end of the year compared to 834 million at the end of 2019. A Big Dividend Increase Is In Harley-Davidsons Future. The iconic motorcycle manufacturer Harley-Davidson said on.

Youll get your decision in minutes. Dollars in revenue for the full 2020 financial year some. Early this week General Motors also announced suspended its 2020 outlook said it was evaluating its quarterly dividend but has not yet decided to suspend it.

The outlook is negative 06 Apr 2020 New York April 06 2020 -- Moodys Investors Service Moodys downgraded the long-term ratings of Harley-Davidson Inc. Harley-Davidson generated 12 billion of cash from operating activities in 2020 compared to 868 million in 2019. Fitch Ratings views HDFS as a core subsidiary of HOG based on HDFS close operating relationship and support agreement with HOG 100 ownership shared branding and the importance of HDFS to achieving HOGs strategic objectives.

Harley-Davidson and Harley-Davidson Financial Services Inc. Harley-Davidson and Harley-Davidson Financial Services Inc. HOG will release its first quarter 2021 financial results before market hours Tuesday April 20 2021.

/cdn.vox-cdn.com/uploads/chorus_asset/file/18731898/595125838.jpg)